Statistics and Valuation Ratios#

This Data Bundle provides company statistics such as EBITDA, ratios, and other key financial data.

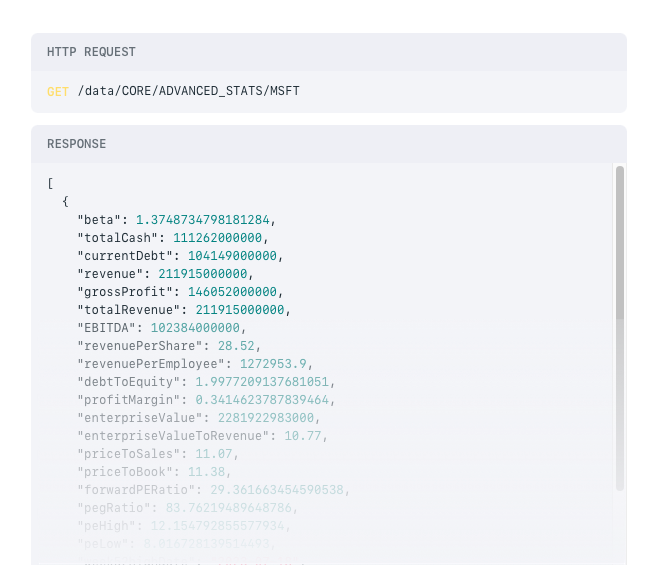

The following image shows response data from the bundle’s Statistics & Valuation Ratios endpoint.

Tip

Purchase this bundle in the Console.

Endpoints#

Statistics & Valuation Ratios - Key statistical information about a company including EBITDA, ratios, key financial data, and more.